What is Multi-Accounting and Where is it Used?

Blog » What is Multi-Accounting and Where is it Used?

To work online, users need accounts. Some users, however, create dozens or even hundreds of accounts for their specific purposes. In this article, we will explore what multi-accounting is, who needs it, whether it is legal, and most importantly, how to 😌 avoid being blocked for multi-accounting.

What is Multi-Accounting? 🤔

Multi-accounting is the simultaneous use of multiple accounts on the same website or service by a single user.

For example, in social networks, one user may create multiple accounts to run ads. In the case of betting platforms, users may create multiple accounts to claim welcome bonuses or bypass the block on their original account for violating the service’s rules.

What is Multi-Accounting Used For?

It depends on the specific field of activity. Most often, multi-accounting is used for the following purposes:

🔺 Bypassing Blocks

If a user’s account is blocked for violating platform rules, they may attempt to bypass restrictions by creating new accounts.

🔺 Increasing Income

For example, arbitrage specialists often work with dozens of advertisers and affiliate networks, requiring as many accounts as possible to launch ads. Additional accounts also serve as backups in case the original account gets blocked.

🔺 Working with Different GEOs

This is often necessary for launching ads on social media or search engines. For example, if an agency works with clients from different countries, they may need accounts from those countries to run ads. Additionally, some users create foreign accounts to reduce advertising taxes, as tax rates vary across countries.

🔺 Bonus Hunting

When registering new accounts, some services offer welcome bonuses. This is common in betting and gambling. Users create additional accounts specifically to claim these bonuses.

Where is Multi-Accounting Used?

Multi-accounting is most commonly applied in:

🔺 Crypto Platforms and Exchanges

Multi-accounting is often used during 💰 token sales (initial token offerings) on various platforms, such as Coinlist.

The reason is that during these initial sales, the number of tokens available is ☝️ limited, and they are sold at initial and 🙋♂️ favorable prices. If the demand for a token exceeds the supply, buyers may be chosen randomly. Therefore, the more accounts a user has, the higher their chances of obtaining tokens.

Other users employ multi-accounting to maintain anonymity and simultaneously manage multiple cryptocurrency wallets. For instance, popular centralized crypto exchanges often require users to provide real passport details when registering a wallet.

Moreover, in April 2022, the popular cryptocurrency exchange Binance introduced ❌ restrictions for certain users: if their assets exceeded €10,000, they could only withdraw funds but were not allowed to buy or sell cryptocurrency. Additionally, according to Reuters, the exchange allegedly shared wallet owners’ data with government authorities in some countries. Binance 🙅 denied this claim, but the matter is now being investigated in court.

To 🏰 protect their data and bypass such restrictions, users often create accounts under the names of other people.

🔺 Betting Platforms

Multi-accounting is used, for example, for:

- Reclaiming welcome bonuses;

- Arbitrage betting: This involves placing opposite bets on the same event across different bookmakers. Typically, arbitrage opportunities are found across multiple betting platforms, but occasionally they can occur within a single platform;

- Continuing to work with a specific bookmaker: For instance, in cases where the original account is blocked or the odds are reduced due to violations of certain rules.

🔺 Parsing

Parsing is the automated collection of data from the internet. Parsers can be used to gather website contacts, prices, content, user data, and more.

However, the laws of each country regulate the collection of such information differently. For example, in many countries, it is illegal to collect users’ personal data without their consent. As a result, websites’ security systems may block parsers. To prevent the same user from attempting to collect data again, protective algorithms can record the IP address and device information used for parsing, blocking these details in the future.

By creating accounts with different data, users can continue parsing information despite these restrictions.

🔺 For Social Media Work

Multi-accounting is needed for:

- Running ads from multiple accounts. For example, this is useful for marketers, media buyers, and arbitrage specialists;

- Posting reviews or comments on behalf of different users. This can be done to improve a brand’s online reputation or to draw attention to a particular topic;

- Bypassing account blocks. Social networks closely monitor their users and actively combat multi-accounting. This is because having multiple accounts raises concerns about their purpose. For instance, someone may use multiple accounts to run illegal ads or influence public opinion by posting positive reviews for products that do not meet those standards. Some social networks may block an entire chain of accounts immediately, while others carefully analyze the user and block them only in case of violations.

What Sanctions are Imposed for Multi-Accounting? 🙅♀️

The strictest measure is the complete account 💯 ban, which prevents access or withdrawal of funds. Such measures are often applied by betting platforms against arbitrage bettors, crypto platforms, or social networks in cases of illegal ad campaigns.

Milder measures include:

- Requesting additional data from the user;

- Temporarily freezing the account;

- Reducing odds (in the case of betting platforms), and so on;

- The specific measures depend on the platform where the violations occurred.

How Do Websites Detect That a User Has Multiple Accounts? 🤔

All criteria for evaluating users can generally be divided into two groups: general and individual.

◾️ General

These criteria are used by all anti-fraud systems and include ⬇️

- Contact and personal data: Full name, date of birth, phone number, email, etc.;

- Fingerprint: A set of anonymized data about your device, connection, and browser. For example, browser type and version, operating system, RAM size, number of ports, etc. The combination of this data forms a unique digital fingerprint, which anti-fraud systems associate with each user. Each anti-fraud system collects a different amount of data; for obvious reasons, none of the services publicly disclose their exact methods;

- IP addresses: Anti-fraud systems detect the location and IP address used to create an account. If the same IP address appears on another account, the system may flag it;

- Cookie data: For example, what websites and resources the user visits;

- Payment method: Matching card or wallet details can automatically link accounts.

◾️ Individual

These are criteria that may not be used by all systems ⬇️

For example:

Tracking user behavior patterns. For instance, in betting platforms, this could include betting habits unique to a particular person;

Random user verification checks. Examples include video calls to confirm the user logged into the account or sudden requests to send a selfie in a specific pose or angle.

How to mask multi-accounting? 🥷

To successfully manage multiple accounts, you’ll need the following:

✅ Proxies 🔗

When visiting any resource, the website detects your IP address. If the same IP address is used for all accounts, the site’s security systems will determine that the accounts are being created by the same person. Anti-fraud systems will automatically link the accounts and may eventually block them.

Proxies allow you to change your IP address, making it appear as if you’re a user from a different country. If you’re having trouble choosing proxies, check out our resources:

- How to choose proxies for an anti-detect browser;

- What’s the difference between HTTPS and SOCKS proxies?

✅ Antidetect browser

Since IP address masking is used even by regular users, anti-fraud systems now analyze users based on additional criteria. An anti-detect browser is a program that alters your real digital fingerprint to make you appear as a different user. Furthermore, it allows you to work with multiple accounts from a single device and within a single browser window.

✅ Data for registering a new user

Each account will require a unique full name, contact details, and payment card (if needed).

Additionally, since some anti-fraud systems use advanced user verification methods, such as sudden photo requests or video calls, you must consider the data you use and the individuals the accounts are registered under when creating accounts.

How can Dolphin{anty} help? 🐬

❗ Dolphin{anty} is an anti-detect browser designed for multi-accounting. It can modify over 20 parameters of your browser and device, including Canvas, WebGL, WebRTC, language, timezone, and more. Thanks to these capabilities, Dolphin{anty} is suitable for ➡️ parsing, betting, social media management, affiliate marketing, and cryptocurrency exchanges.

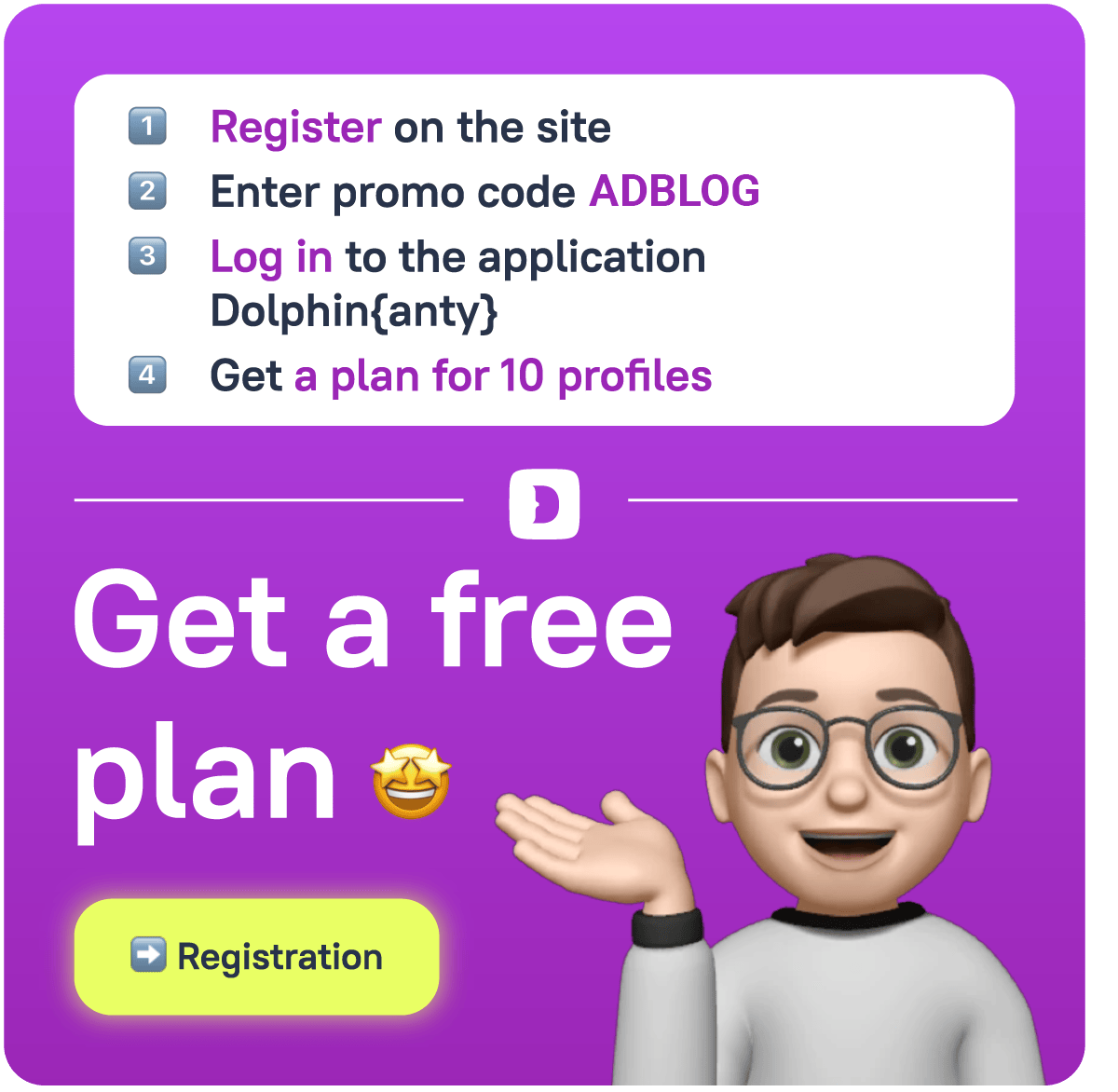

If you’ve never used an anti-detect browser before, you can test it with a 4-day free trial and continue working with a free plan that allows up to 10 browser profiles.